The 15-Second Trick For Pvm Accounting

The 15-Second Trick For Pvm Accounting

Blog Article

Pvm Accounting Fundamentals Explained

Table of ContentsThe 6-Second Trick For Pvm AccountingThe Ultimate Guide To Pvm AccountingSome Known Details About Pvm Accounting Pvm Accounting Can Be Fun For AnyoneAll About Pvm AccountingThe Best Strategy To Use For Pvm Accounting

Oversee and take care of the creation and approval of all project-related payments to clients to foster good interaction and stay clear of concerns. construction accounting. Make sure that appropriate records and documents are submitted to and are updated with the internal revenue service. Ensure that the accountancy process follows the law. Apply needed construction bookkeeping criteria and treatments to the recording and reporting of building task.Communicate with numerous funding agencies (i.e. Title Company, Escrow Firm) regarding the pay application procedure and needs required for repayment. Help with carrying out and preserving internal economic controls and procedures.

The above declarations are intended to explain the basic nature and level of job being carried out by people designated to this category. They are not to be construed as an exhaustive listing of obligations, responsibilities, and skills needed. Employees may be required to do obligations outside of their typical responsibilities every so often, as required.

6 Simple Techniques For Pvm Accounting

Accel is looking for a Building and construction Accountant for the Chicago Workplace. The Building Accounting professional carries out a range of accounting, insurance compliance, and project management.

Principal tasks consist of, however are not restricted to, taking care of all accounting functions of the business in a prompt and precise fashion and offering records and schedules to the firm's CPA Company in the preparation of all monetary declarations. Guarantees that all accountancy treatments and functions are handled properly. In charge of all financial records, pay-roll, financial and daily operation of the accountancy feature.

Functions with Task Supervisors to prepare and publish all regular monthly invoices. Creates month-to-month Task Cost to Date records and working with PMs to integrate with Task Supervisors' budget plans for each project.

How Pvm Accounting can Save You Time, Stress, and Money.

Effectiveness in Sage 300 Building and Actual Estate (formerly Sage Timberline Office) and Procore building and construction management software application a plus. https://www.imdb.com/user/ur182049357/. Have to also excel in various other computer system software systems for the prep work of records, spread sheets and other bookkeeping analysis that may be required by monitoring. financial reports. Must have solid business abilities and ability to prioritize

They are the economic custodians who make certain that building jobs continue to be on budget, adhere to tax obligation laws, and maintain financial transparency. Building accounting professionals are not simply number crunchers; they are critical companions in the construction process. Their primary function is to handle the monetary elements of building and construction tasks, guaranteeing that resources are assigned effectively and monetary dangers are reduced.

Pvm Accounting for Beginners

They work closely with task managers to develop and check budget plans, track expenses, and forecast economic needs. By keeping a tight grasp on job financial resources, accounting professionals assist prevent overspending and monetary problems. Budgeting is a keystone of successful construction tasks, and construction accounting professionals are instrumental hereof. They develop detailed spending plans that include all task costs, from materials and labor to authorizations and insurance policy.

Browsing the facility internet of tax obligation guidelines in the building and construction sector can be tough. Construction accounting professionals are fluent in these policies and make certain that the task follows all tax requirements. This consists of managing payroll taxes, sales tax obligations, and any type of other tax commitments certain to building. To master the duty of a building and construction accountant, people require a solid educational foundation in accounting and money.

Additionally, qualifications such as Certified Public Accounting Professional (CPA) or Licensed Construction Market Financial Specialist (CCIFP) are very concerned in the sector. Construction jobs frequently include limited target dates, changing policies, and unforeseen costs.

The Buzz on Pvm Accounting

Professional certifications like certified public accountant or CCIFP are additionally very advised to show competence in construction audit. Ans: Construction accounting professionals develop and monitor budgets, determining cost-saving chances and making sure that the job remains within budget plan. They likewise track costs and projection monetary requirements to stop overspending. Ans: Yes, building and construction accounting professionals handle tax compliance for construction tasks.

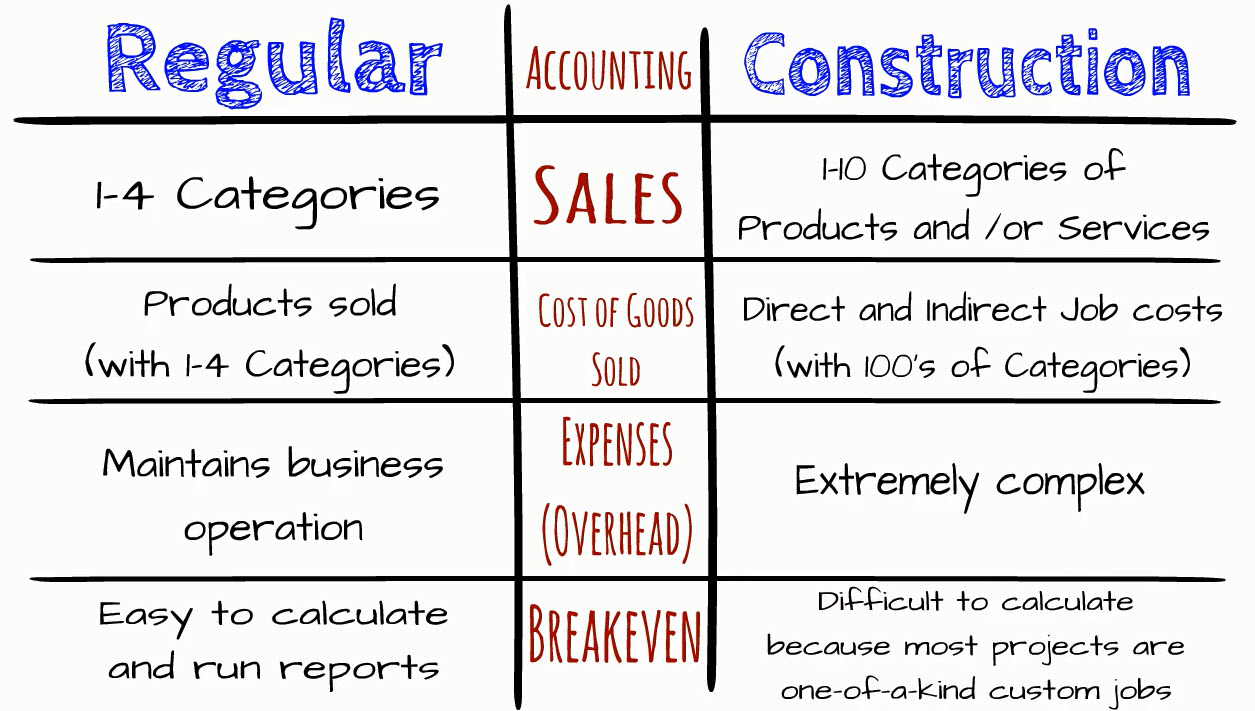

Introduction to Building And Construction Bookkeeping By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building business have to make challenging options among numerous financial alternatives, like bidding process on one project over an additional, picking financing for materials or equipment, or establishing a job's revenue margin. Construction is an infamously unstable industry with a high failing rate, slow-moving time to repayment, and irregular money flow.

Typical manufacturerConstruction business Process-based. Production entails duplicated processes with conveniently identifiable costs. Project-based. Manufacturing requires different processes, products, and devices with varying costs. Taken care of place. Manufacturing or manufacturing occurs in a single (or several) regulated places. Decentralized. Each project occurs in a brand-new this link place with differing site conditions and one-of-a-kind difficulties.

Not known Details About Pvm Accounting

Resilient partnerships with suppliers reduce negotiations and boost efficiency. Irregular. Constant usage of various specialized service providers and suppliers affects performance and cash money circulation. No retainage. Settlement shows up in full or with regular payments for the complete agreement amount. Retainage. Some portion of payment might be kept up until project conclusion also when the specialist's work is ended up.

Routine manufacturing and temporary agreements bring about convenient cash flow cycles. Irregular. Retainage, slow payments, and high upfront expenses result in long, irregular cash flow cycles - construction bookkeeping. While standard makers have the advantage of controlled settings and maximized manufacturing processes, construction companies have to constantly adjust to every new task. Also somewhat repeatable tasks require modifications as a result of site problems and other factors.

Report this page